I suppose it must happen to all of us around the age of 50 – I see it in my clients all the time. There’s something about hitting that milestone that makes us look ahead, and start thinking more seriously about our retirement planning.

Many Americans get to 50 with no real retirement savings to speak of, or with their 401k underperforming. Others are way ahead of the game and have been planning since their first paycheck.

Believe me when I say that either of those are fine. If you’re in the first group, it’s not too late to start retirement planning at 50. And I’m sorry to say, but even if you’re in the super well organized, forward thinking group, the chances are there are some elements of planning that you might have missed.

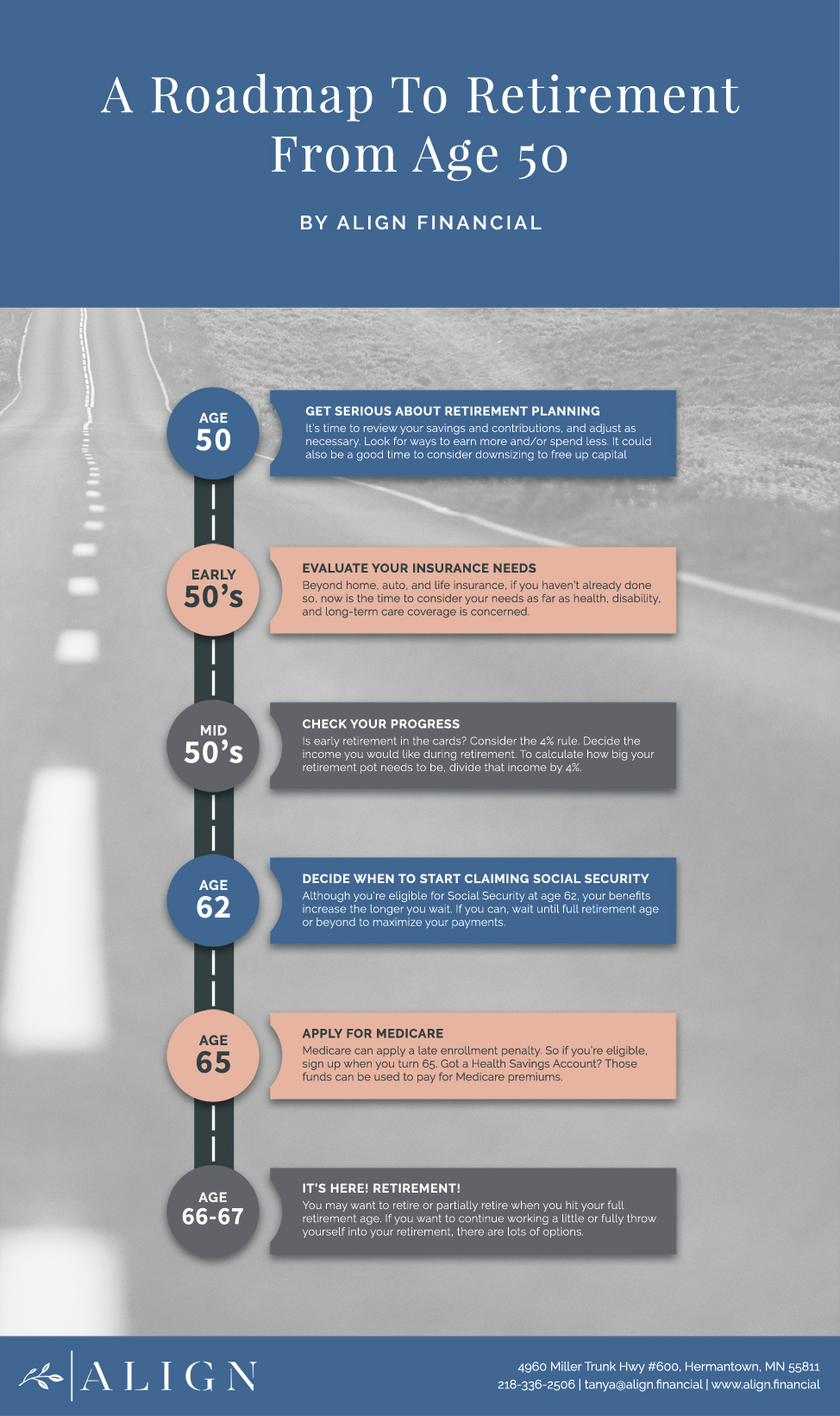

We’ve found that a lot of our clients really value knowing whether they are on track for retirement or not, so we’ve put together a roadmap to retirement from 50. It will help guide you from your peak working years right through into a comfortable and happy retirement.

Age 50: Get Serious About Retirement Planning

When you hit 50, it’s a great point to review your financial position and generally take stock of where you are. While many people might just look at their 401k or other savings, there’s lots of other things to consider.

How Much Should You Have Saved?

Many people want a yardstick to measure their progress against, and ask me how much money they should have saved by a certain age. To maintain your lifestyle throughout retirement, the general recommendation is to have saved around six times your annual salary by age 50. If you’ve not got to that kind of figure yet, don’t panic. Most Americans haven’t. But that’s the ideal, and there are ways to catch up now.

Make the Most of Your Earning Years

These are your peak earning years. You may have been established in your career for a long time, or you might have been somewhat held back due to prioritizing your family life. If you were, then maybe your children are more independent now. That will inevitably free up some of your time, and you can put aside more time to really invest in yourself now.

So this is a great time to look around for ways to increase your income. Apply for a higher paid role in a new company. Negotiate a raise, chase a promotion, or give your career a boost with a lateral move at work that could increase your skill set for a move upwards later on.

Free Up Some Capital

If you’ve reached your 50s and found yourselves as empty nesters, do you really need that five-bedroom house? If you downsize now, you can save money over the next few years in maintenance of that property, and also free up some capital to reinvest in your retirement accounts.

And make a steady plan to pay off all your outstanding debt as long before retirement as you can. You won’t want unnecessary drains on your resources once you’re no longer earning, and paying off debt can mean there’s extra money to be put into your savings instead.

Review Your Projected Retirement Income

This is quite a big one, and this could be where it’s really useful to get some professional help with your retirement planning. Working out your projected retirement income involves a complicated, but methodical, analysis of your situation.

But firstly, give yourself a rough time frame for your retirement. Do you plan to work up until full retirement age (that’s 66 or 67, depending on when you were born), or even beyond? Then work out what your projected income would be, based on your retirement benefits, your portfolio and your Social Security benefits. Are there ways to increase any of these? Can you increase contributions to your retirement accounts, or work a few more years to delay taking Social Security benefits to maximize payments?

Review your portfolio at this stage. Its activity now is important – you might want to think about moving it into less risky investments, so your retirement income is more dependable. Think about whether it would be sensible to alter any of the allocations. And think about the income that you’re hoping to generate from your portfolio. Ask your advisor for recommendations as to improving this.

Do You Have Adequate Insurance?

In your early 50s, start to look ahead at insurance matters. Getting the right insurance now will protect your assets later. After all, they will struggle to bounce back from any big financial payouts for uninsured events.

While you’ll want to make sure you’re comprehensively covered in terms of auto, home and life insurance, probably the most important insurance to be on top of as you age is health insurance. That includes disability and long term care insurance as well.

Health matters, including long term care, can cost hundreds of thousands of dollars in retirement. When the average American retires with $172,000, most retirement nest eggs just won’t come close to meeting those bills. So it’s vital to be well prepared and this needs to be a central part of your retirement planning. You can do that with robust insurance coverage, so your early 50s is the time to be getting those policies in place.

Maximize Your Savings

As part of your retirement planning, make sure that you’re aware of how your retirement savings accounts work. That means fully understanding them in terms of their tax implications, the maximum contributions you can make to them and the distributions upon retirement.

The important thing to do in your 50s is to maximize your contributions to them, by making additional catch-up payments if you can. After age 50, you’re allowed to contribute $6,000 more to your 401k (so now that makes a total of $24,000 in contributions per year), and $1,000 more per year to your IRA.

If you haven’t already done so, look into a health savings account. Only a small percentage of eligible Americans currently have one, and they can be a really important and helpful part of your retirement planning.

Any money saved in an HSA is set aside for health-related expenses which can be especially useful in retirement. They’re tax-preferred accounts, so there’s lots of benefits to having one. Once again, catch-up payments can be made to these savings accounts after the age of 50.

Spend Less to Save More

The ultra-frugal amongst us might start to use their 50s as a time to spend less, and save more. So keep an eye out for discounts! Although you might not be feeling like a senior just yet, senior discounts at different restaurants, retailers, leisure facilities start at 50. If you can lower your monthly expenses by taking advantage of these discounts, you could increase your contributions to your savings accounts.

Think about joining AARP to stay up to date with discounts and deals for seniors to help you make the most of your money both during your 50s and into retirement. Don’t forget to find out all the benefits that seniors are eligible for in your area, as these vary from state to state.

Age 55: Is Early Retirement On the Cards?

Maybe your planning has involved an early retirement. If that’s the case, you’ll need to ask yourself if you have adequate funds in place to generate sufficient income. A general guideline when it comes to making that decision is to consider the 4% rule.

Decide upon the income that you would like during retirement – and we should limit ourselves to realistic realms of possibility here. So let’s say that you were earning $100,000 before retirement, and you’d like to maintain your lifestyle. In that case, you’re going to want an annual income of at least $80,000 during retirement.

To calculate how big your retirement pot needs to be, you need to divide that income by 4%. In this case, that will give you $2 million. If $50,000 would suit you, you’d need to start with $1.25 million. Remember, you can take into account any other expected retirement income, and that will bring the required size of your nest egg down.

Don’t forget that retiring early will have implications for your Social Security payments, if you were expecting them. It will reduce the contributions you’ve made to them over the years, so could significantly reduce the amount you will receive over your retirement. It can also have tax implications, and some savings accounts like HSAs have age-associated restrictions. Make sure you talk all of these through with a trusted financial advisor.

Age 62: Social Security Benefits, But at a Cost

You can start taking social security benefits at any time from 62, but they will be reduced from the figure you would receive if you retired at your full retirement age. Your retirement age will depend on the year you were born; your Social Security payments will reduce incrementally month-over-month, between your actual retirement and your full retirement age.

This table will give you an idea of the reductions from your Social Security payments if you start to take them at 62.

Working later than 62 will have distinct advantages. You will contribute more to your retirement accounts during those extra working years, so end up with a healthier retirement fund. And if you’re likely to depend on them as an important part of your retirement income, it will maximize those Social Security benefits.

Age 65: Apply for Medicare

Even if you’re not planning on retiring at or by 65, you should apply for Medicare at this point. Medicare helps with the healthcare coverage for Americans over the age of 65, the extent of which depends on their work status during their non-retired years.

Most people will get premium-free coverage of Part A associated costs (hospitalization coverage for over 65s) whereas everyone who wants Part B coverage will need to buy it. You can check your eligibility for Medicare here.

It’s important to remember that Medicare can apply a late enrollment penalty. So if you’re eligible, make sure to sign up when you turn 65. And if you’ve been saving into a Health Savings Account, those funds can be used to pay for Medicare premiums.

Age 66 or 67: It’s Here! Retirement!

You may want to retire or partially retire when you hit your full retirement age. If you want to continue working a little or fully throw yourself into your retirement, there are lots of options. There’s also lots to consider at this stage too, such as applying for Social Security and adjusting to your income coming from distributions from retirement accounts.

The transition into retirement itself deserves another post of its own. For now, if you’re taking the steps we’ve outlined, you should be well prepared when the time comes to make the transition to a fulfilling and happy retirement.

If you’d like to talk any of this through and give some real purpose to your retirement planning after 50, then please do get in touch. We love to see our clients progress towards retirement knowing that they’ve put all the pieces of the puzzle into place. We can help you do that too.