Many of us spent our spare time in college indulging ourselves in many of the educational, and not-so educational experiences afforded to us. Whether you were a free love philosophy type, or free beer loving frat boy, much of our formative years were spent in pleasure seeking. Cash flow management, budgeting and financial independence were not often high on the priority list; since there was often little money to manage.

What’s interesting to me, as a financial planner, who spends most of her time listening and understanding people and their financial situation; is hearing how they currently make life altering financial decisions. It seems that for a lot of us, a lack of financial learning in our formative years carries with us as we age. There is often not much thought put into our financial decision making.

A GAP IN OUR LEARNING

We spend years thinking about basking on the beach when we finally retire, with very little idea of how we might pay for that beach once our paycheck stops.

We read books about our chosen field of work. Maybe we even go back to school, spend time at conferences, or find a mentor; many of us are constantly improving our skill. We may seek a therapist for marriage problems, or a tutor for our child to try to help his academic life.

But when it comes to this strange world of personal finance, it seems we don’t even know we need help.

We are supposed to intuitively know how much to save to buy the new car, or to keep in a savings account. And retirement – is $1M enough? And even if we have enough self-awareness to ask for help, where do we go?

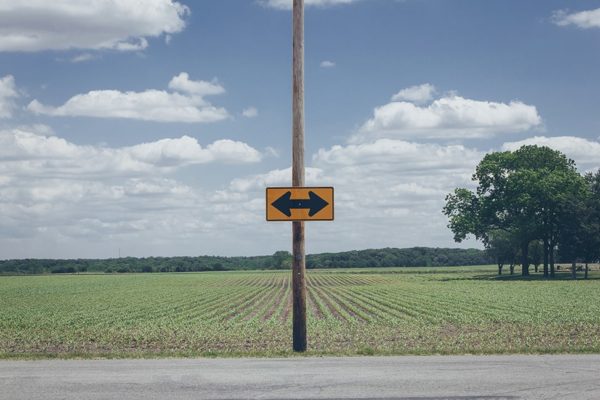

A LACK OF DIRECTION

Clearly the banking industry has abandoned their responsibility to help people make responsible financial decisions, and continues instead to roar full blast into financial product sales. Who is here to help us navigate this strange world of personal finance?

As people no longer balance checkbooks, or use a register; how do we manage our money? How do we save and plan for a future when everything is moving 100 miles an hour? If you’re a 30-year-old thinking about buying a house, and wondering how much house to buy, and how much to put down on the house – who can help? What if you are 50, and you haven’t started saving yet?

Many financial advisors don’t provide any advice unless there is actually money to invest, and anyone that will talk to you often doesn’t have a lot of experience. There is an entire generation walking into the world with mountains of debt, and little to no education or experience in their personal financial situation.

THE POWER OF EDUCATION

So unless you had the benefit of good teachers in your parents or someone close to you, how do you learn about this? It should be a skill we learn in college, much like we all are required to take a foreign language. But until our schools make a personal finance and budgeting class mandatory, the gap in your education will be up to you to fill.

So where do you start?

Hire A Professional

This is always going to be your surest way to securing a strong and lasting financial foundation. It’s important to do your research and select a financial advisor who is experienced and highly qualified. It’s also important for you to feel that you like the person.

Do you feel comfortable talking to them? Do they actually listen to you? Or are they doing all the talking? And can you see yourself building a long-lasting relationship as they guide you through life’s many financial milestones?

Not everyone can afford this option though. So if that’s the case, what can you do?

Google Is Your Friend

Today’s youth are blessed with an endless source of information at their fingertips. So when it comes to your finances, make Google your new best friend. Got a question? Type it into that trusty search bar and spend some time reading the results.

Blogs Are Brilliant

There are so many people out there sharing great advice for free via blogs. These range from experienced professionals like myself, to regular people simply sharing their financial journey online in the hopes that others might benefit from their experience. Some good ones to get you started include:

Don’t Forget Your Real Friends

Many people find it hard to talk about money, or feel it is still taboo. But talking about finances is an important way of learning and understanding. Try bringing the topic into conversation with your friends and ask them how they feel about their financial life.

Or imagine what it would be like to be able to ask your friend or colleague how they made their last big purchase decision to buy a car or a house? You could even start up a regular mastermind group where you all get together to discuss money issues and hold each other accountable as you work towards financial targets.

Plugin To Podcasts

Podcasts are another amazing resource, and can be particularly useful for those who find it hard to sit down and read an article. A simple search on iTunes for financial podcasts will bring up dozens of options for you. This article from Inc. has also done some of the searching for you. Pop one on during your commute, while you’re at the gym, walking the dog, or driving to work. There are always ways to find time to listen and learn.

Lose Yourself On YouTube

If visuals are more your thing, then YouTube is an endless treasure trove of financial guidance. Most bloggers and podcasters will also post videos, so you can maximise your learning by checking out the various ways they share information, and see which method has the most lasting impact on you. We all absorb information differently, so it’s important to find the right way for you.

Books, Books, Books

As an avid reader who can lose themselves for hours in a good bookstore, there’s nothing better than turning to a trusty old book. Leave an inspirational stack by your bedside so you always have something to dive into at the end of the day. Highlight sections, scribble in the margins, add sticky notes… use these books as tools to help you build towards a life of financial confidence.

HOW TO SUPPORT FLEDGLING FINANCES

It’s important for those of us that do have a good level of financial knowledges make ourselves available to share what we know with the people around us. Talk to your family and friends, and try and break down the barrier that seems to prevent us from openly sharing our stories.

If you’ve achieved a level of financial confidence that you’re willing to share, make people feel safe to come to you if they have doubts or fears or questions they can’t find the answers to. Opening the door to financial freedom may just start with opening ourselves to a good conversation with those eager to learn.

And if you’d like to discuss this topic in more detail, I welcome your questions, and invite you to get in touch.