As I promised to many of you during the Equifax Data Breach late last year, I’m writing to share my take on the different credit monitoring services and identity theft protection options available.

In light of recent data breaches, interest in both credit monitoring services and identity theft prevention have risen. While they may seem like similar programs, it is crucial to understand what these programs are and what they do, and don’t do. Below are some important pieces of information to consider before enrolling in a credit or identity monitoring service.

HOW CREDIT AND IDENTITY MONITORING WORKS

Credit and identity monitoring services typically monitor your credit reports for unusual activity and scan for other indicators that someone is already using your identity. It’s important to note, however, that these services do not prevent identity theft, they typically just notify you in the event of unusual activity on your credit file. They also often offer services such as insurance for the expenses accrued remedying the identity theft and replacing stolen funds.

EFFECTIVE SOCIAL SECURITY NUMBER PROTECTION

From my standpoint, the most effective way to stop identity thieves from using your Social Security number is to freeze your credit with each of the three major credit bureaus. This is really the best way to stop anyone from using your information to borrow money or open accounts in your name.

After digging into this topic, the monitoring services just monitor – so they just tell you what happened on your credit file. This is good because you can catch it quickly, but it doesn’t typically stop it from happening. So if you want to protect yourself, the freeze is the best (and cheapest) option – but it has its drawbacks. The main one being, when you want to borrow money or open a new account you have to “thaw” your credit or lift the freeze.

I just helped a client do this, and it only took about 20 minutes online, but she had to have all her passwords for the three bureaus and be comfortable on the computer. In her case, they were at the dealer trying to buy a car and it was inconvenient because she had forgotten they froze their credit after the breach. So they had to wait until they could thaw the credit that night before they could go back to purchase the vehicle.

Despite this inconvenience, if security is your priority – the freeze seems to be the best option. It really puts the control of who reads your credit report back in your hands.

This can be done with ease either online or over the phone, and can cost anywhere from $0 to $10 per bureau depending on where you live.

- Equifax: Visit their website or call 866-349-5191

- Experian: Visit their website or call 888-397-3742

- TransUnion: Visit their website or call 888-909-8872

If and when you need to lift the freeze, you will have to pay the same fee. To lift your freeze, you contact the bureau used by the lender and provide your PIN to lift the freeze for a certain period of time. Again, this can be done online or over the phone.

This fully stops thieves from opening new accounts or taking out loans under someone else’s name. Additionally, request a copy of your credit scores with each bureau to scan for suspicious inquiries.

HOW TO SELECT A MONITORING SERVICE

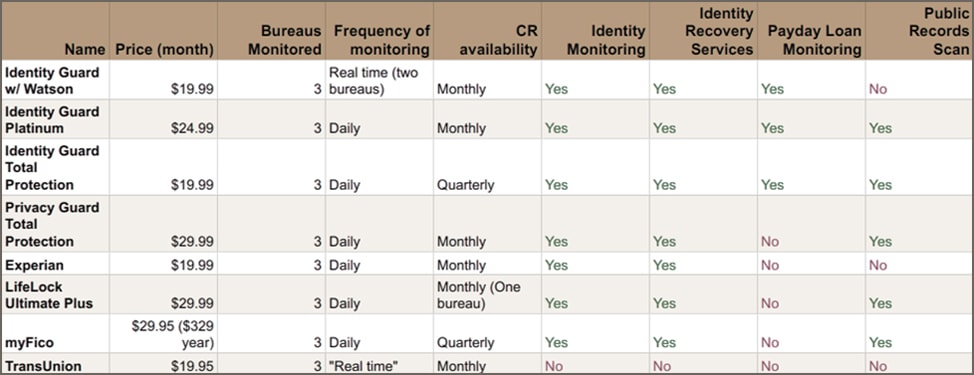

For those of you interested in the various monitoring services, here is a breakdown of the most comprehensive credit and identity monitoring programs. Programs that monitored fewer than all three major bureaus were omitted and all of the following are insured up to $1,000,000, which means that the program provides up to $1,000,000 of coverage in the event of identity theft.

Of all of the above programs, Identity Guard Total Protection offers the most comprehensive monitoring of both credit and identity at a competitive price. For ten dollars more a month, Identity Guard Platinum will provide updated monthly credit reports for all three bureaus, however, that is the only major difference between the two plans.

By understanding the differences between monitoring credit and identity versus protecting it, sensitive information can be protected in the most effective way possible. For those of you interested in maximizing your protection – while possibly more inconvenient but less costly, the freeze is probably the best option.

And if you’re anything like me, and always like to dig that little bit deeper with your information gathering, then there is an interesting podcast from NPR that you might enjoy. It discusses the credit bureaus, and gives some background history on how they came to be. Definitely worth checking out!

If you’d like to discuss this topic in more detail then we invite you to get in touch.